Can My Car Be Totaled By Hail?

Auto Insurance varies by company and state on the guidelines to declare a vehicle total loss. Most insurance companies will evaluate the actual cash value (ACV) of your vehicle at the time of loss to determine if the repairs exceed a certain percentage of that value. When your insurance adjuster inspects your vehicle, they will deduct any unrelated prior damage (UPD) or previous hail damage not repaired. Most customers assume their insurance cannot detect any past hail storm damage, but this usually isn’t the case. Each storm has specific details that will produce a certain size and depth of the dents. If you received a check for prior hail damage repairs without repairing, your insurance will most likely deny your new or any additional claims. This is why it is not recommended on keeping any funds for repairs your insurance sends you. Other factors that will impact the total loss evaluation include the vehicle’s age, pre-loss condition, and local market conditions for value and possible settlement amount.

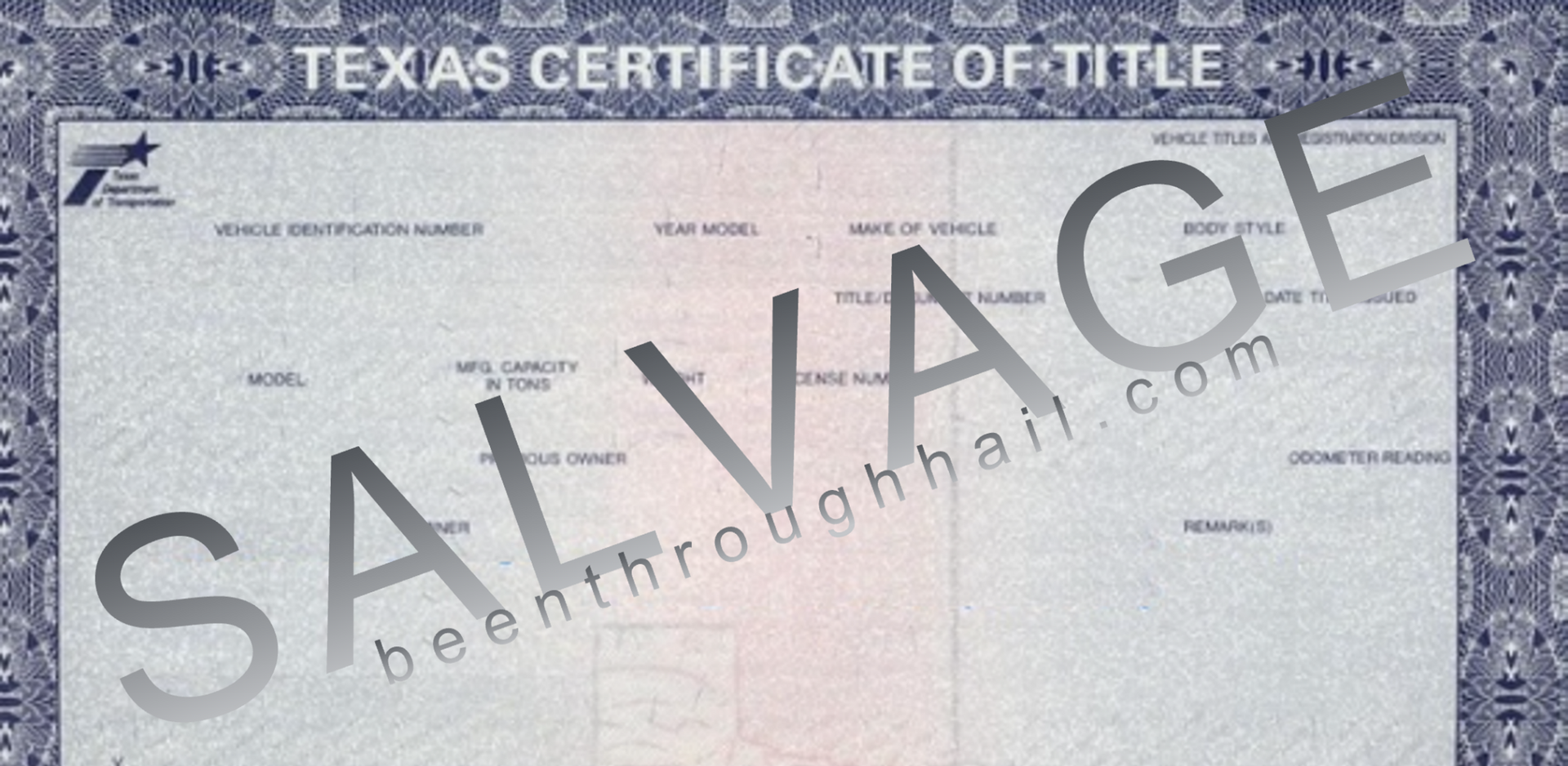

If your vehicle’s repair costs exceed the value, then it is not worth repairing and is declared a total loss. If your vehicle does get declared a total loss from hail damage, you need to follow the right steps to get paid out from your insurance. Before you contact your insurance, be sure to document all hail damage with detailed photos and possibly even a video. Your insurance will then send out an adjuster to inspect the damage to determine what the ACV amount is. Your insurance will then give you options on whether or not you want to keep the vehicle. If you decide to allow insurance to take the vehicle, they will send you a check for the ACV prior to the hail damage, but will subtract your deductible amount. If you decide to keep your vehicle, insurance will allow you to purchase it from them at salvage value. This means your vehicle will obtain a salvaged title, and will significantly impact insurance options as well as the value. Keep in mind that if you have a car loan, your lender may have a say in whether you can keep the car.

You've Been Through Hail & Need The 411